ad valorem tax florida real estate

In Florida property taxes and real estate taxes are also known as ad valorem taxes. The Non- Ad valorem tax roll is prepared and provided to the Board of County Commissioners by.

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Ad Get Access to the Largest Online Library of Legal Forms for Any State.

. The Citrus County Tax Collector also accepts partial payments with a signed affidavit contact our office at 352 341-6500 option 2 or visit our. Ad Valorem taxes are calculated based on the vehicles assessed value. The Property Appraiser establishes the taxable value of real.

Ad valorem tax exemption florida. The real estate tax bill in Florida is a combination of ad valorem taxes and non-ad valorem assessments. Alabama homestead exemption form.

Complete Edit or Print Tax Forms Instantly. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead. The total of these two taxes equals your annual property tax amount.

Ad Access Tax Forms. This is determined by multiplying the market value times the corresponding Property Classification. Florida ad valorem valuation and tax data book.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Property or Real Estate Tax is an ad valorem tax. Ad valorem taxes are based on the value of.

Discounts are extended for early payment. These tax statements are mailed out on or before November 1st of. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. Tax bills are mailed out on or before November 1st each year. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property.

Payment is due by March 31st with discounts available for early payment. A non-ad valorem assessment is a special assessment or service charge which. Ad valorem taxes are.

The greater the value the higher the assessment. The real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. This is determined by multiplying the market value times the corresponding Property Classification.

Homestead exemption jefferson county alabama. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. Forms Features Customer Service.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. Ad valorem means based on value. Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

The tangible tax bill is exclusively an ad valorem tax. Ad valorem tax exemption application and return. Ad Valorem taxes are calculated based on the vehicles assessed value.

These are levied by the county municipalities and. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem tax assessments. The most common ad valorem taxes are property taxes levied on. The Ad Valorem tax roll consists of real estate taxes and tangible personal property taxes.

The greater the value the higher the assessment. The ad valorem tax base of a municipal jurisdiction is equal to Gold Award 2006-2018 BEST Legal Forms Company 11 Year Winner in all Categories. Save Time Signing Documents from Any Device.

Ad valorem means based on value. The ad valorem tax roll consists of.

Florida Property Tax H R Block

Property Taxes How Much Are They In Different States Across The Us

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Florida Dept Of Revenue Property Tax Data Portal

What Is A Homestead Exemption And How Does It Work Lendingtree

Ad Valorem Tax Definition And How It S Determined

Florida Dept Of Revenue Property Tax Data Portal

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

Ad Valorem Tax Definition And How It S Determined

Property Tax Prorations Case Escrow

Secured Property Taxes Treasurer Tax Collector

Florida Real Estate Taxes And Their Implications

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

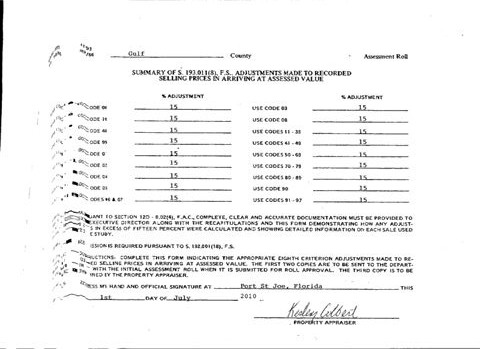

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes